Have you been familiar with the term ‘Forex Brokers’? For those who haven’t, be sure that it is quite crucial to a country’s economy and the general well-being of a country’s people in all monetary difficulties. If you want to start trading in forex, you should hire the best forex broker. You can find the best one after reading this article. Read Our Avatrade Review to find out which broker you should hire. In this guide, we will look at the importance of the foreign market and go into all the details related to it.

Overview of Forex Broker

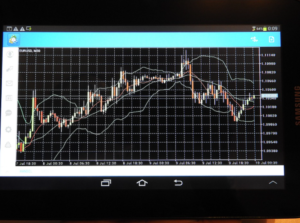

Companies that are all cash traders and provide accessibility to many platforms on which they can trade and buy or sell foreign trade are based. They are known as trading agents or, occasionally even forex brokers. Although approved and well recognized, these brokers handle a very small portion of the total forex trading of a particular state. Still, their purpose is quite significant and cannot be ignored. The 24 hour forex market can be well managed with the help of these brokers with fantastic ease.

How Are They Compensated

There are basically two methods to be compensated by forex brokers. The very first method, and the very best, is by distributing a pair of money through supply and demand. A fantastic example would be that if a forex broker buys some euros to get USD 2,250, he also sells all the bought back euros for USD 2,255, also making this additional margin. Also, like everyone else, these brokers charge a trading commission based on the amount that is traded. But one thing to keep in mind that favors many clients is that there has been a profit in volume for these brokers over the past five or six decades. So, as it has gained customers, there has been a sudden drop in the trading rate these brokers price due to increasing competition among money brokers.

There are basically two methods to be compensated by forex brokers. The very first method, and the very best, is by distributing a pair of money through supply and demand. A fantastic example would be that if a forex broker buys some euros to get USD 2,250, he also sells all the bought back euros for USD 2,255, also making this additional margin. Also, like everyone else, these brokers charge a trading commission based on the amount that is traded. But one thing to keep in mind that favors many clients is that there has been a profit in volume for these brokers over the past five or six decades. So, as it has gained customers, there has been a sudden drop in the trading rate these brokers price due to increasing competition among money brokers.

Steps to Choose the Best Forex Broker

From comparing forex brokers is to perform a thorough analysis of the specialized services they offer. By performing a strong broker comparison, you can distinguish between the best and the rest of the forex brokers. Your comparison should largely revolve around the purchase price, convenience, and experience of the broker.

Compare the Price

Different forex brokers charge different prices for their services. In a society where frugality is the magic word, it would not be surprising if your contrast is based solely on price. However, there is also the question of utility when making a comparison. Choosing a broker that costs less but provides a lower quality of trading is significantly worse than choosing a broker that costs a little more but provides the absolute best benefits, such as tips and ideas.

Find Out Their Professional Reliability

Convenience, on the other hand, is the most important issue coming in. Some brokers expect you to execute the entire forex trade in their offices; others allow you to confirm trades in person within a day, although others provide additional time for validation. When comparing, look carefully at times the broker can be contacted for trades and its accessibility. The best forex broker is always available and only closes for a few hours on weekends—the more cell phones that are accessible after hours, the better.

Check Out Their Experience and Skills

This contrasting procedure is much easier for a beginner to handle. On the other hand, a close forex comparison can show you that experienced forex traders may have outdated strategies, and their previous shortcomings may creep into their trading procedures. The solution, in this case, is entirely up to you and your intuition. Then, when you are done comparing brokers and have your points in hand, you can make a solid decision based on the details.

It would help if you started tracking your daily, weekly, and monthly expenses. Then, you can find expenses that are not necessary and write them off. Once you’ve identified these items that aren’t worth it, you can reduce your expenses by 25-30 percent. It is highly recommended that you only have one credit card so you can better control your spending. It’s essential to make sure to cover the full amount from the due date of each credit card bill until it becomes an incredible debt.

It would help if you started tracking your daily, weekly, and monthly expenses. Then, you can find expenses that are not necessary and write them off. Once you’ve identified these items that aren’t worth it, you can reduce your expenses by 25-30 percent. It is highly recommended that you only have one credit card so you can better control your spending. It’s essential to make sure to cover the full amount from the due date of each credit card bill until it becomes an incredible debt. Today, some people believe that retirement means working many years in public service and then moving on to a lifetime of retirement. Even if you have several assets, you can’t work indefinitely. At some point, you have to make room for younger, more energetic people. I have seen some people today go broke after retirement due to a lack of proper preparation. They wait for some handouts from the government or some organization to be called a pension before they can survive. It’s a life of misery unless you have to live your whole life depending on other people to survive.

Today, some people believe that retirement means working many years in public service and then moving on to a lifetime of retirement. Even if you have several assets, you can’t work indefinitely. At some point, you have to make room for younger, more energetic people. I have seen some people today go broke after retirement due to a lack of proper preparation. They wait for some handouts from the government or some organization to be called a pension before they can survive. It’s a life of misery unless you have to live your whole life depending on other people to survive.

The best way to improve your savings is simply to increase the amount that you earn. Increasing your earnings means that you have more to put into your savings account. You simply need to ensure that your needs do not increase proportionately to the increased amount so that you are left with extra money for saving. You can improve your income through many ways. Among the top ones include investing in business, working extra hours, or taking a part-time job.

The best way to improve your savings is simply to increase the amount that you earn. Increasing your earnings means that you have more to put into your savings account. You simply need to ensure that your needs do not increase proportionately to the increased amount so that you are left with extra money for saving. You can improve your income through many ways. Among the top ones include investing in business, working extra hours, or taking a part-time job.