Most people agree that a personal loan is the first-class method to find money immediately available. There are some credit and financial institutions that provide immediate financial assistance to potential and actual loan applicants. These creditors offer favorable terms so that the borrower can obtain a loan together. But such loans are the most appropriate way to find a quick loan, especially if you need an emergency 24hrs loan in Nigeria. In assessing the urgency, most lenders also offer personal loans online, making them more acceptable to the borrower.

Options to Personal Loans Online

Almost all lenders offer simple online tools to obtain a personal loan on their websites. You can use these online options to apply for a loan or to search for details to obtain a loan you need. These online options on lenders’ websites can be used to assess and compare interest rates. These options can also allow the customers to compare the loan processing fees and other costs that lenders may charge for obtaining the loan together. The borrower can obtain a loan in installments or some immediate payment loans through the online application process, even if it is almost always a direct short-term loan. Here is what you should know about getting personal loans online

Benefits of Personal Loans Online

Let’s take a look at the benefits you could enjoy with this type of loan. First, personal online lending offers easy acceptance. Compared to other types of loans, it is much easier to get confirmation. Online lenders often have low standards that you could easily meet to get approval. If you have poor credit, you can find online lenders that offer online credit providers that suit your needs. If you fill out a financing request with the lender using a negative credit score, your request will most likely end up in regret.

It is also less cumbersome. When applying for financing from banks and other institutions, the boring part is the documentation that must be submitted and faxed. You will need to present the perfect credentials to obtain a funding commitment. But when you apply for a loan online, you don’t have to do the same boring things. You don’t have to queue up or go to the lender or other institutions to get the loan.

Drawbacks of Personal Loans Online

Although many advantages could make an online loan program quite attractive, it also has its disadvantages. It is unsatisfactory that personal online lending involves high interest rates and fees. Experts advise against pursuing this particular loan unless the need is urgent. Online loans have higher interest rates and fees than ordinary loans, except for the high interest rates and fees you have to pay when registering on your website. Also, in case of late payment, you must pay a fee.

In addition to this, it also requires a short-term repayment plan. Routine loans from banks and other institutions can provide you with a payment plan extending your debt repayment over a longer period. Repayment can be made over one or two years if you receive a regular loan. It can be done in two days or a few weeks. The obscure wording and statement of conditions are also provided in this type of loan.

With some financial lending solutions, certain conditions and requirements put you in a high-risk scenario. This is sometimes deliberately hidden or left unclear why people do not want you to know. Although it is useful, you will discover things to consider before you get an online lending program. It would help if you always thought about the pros and cons before deciding on anything.

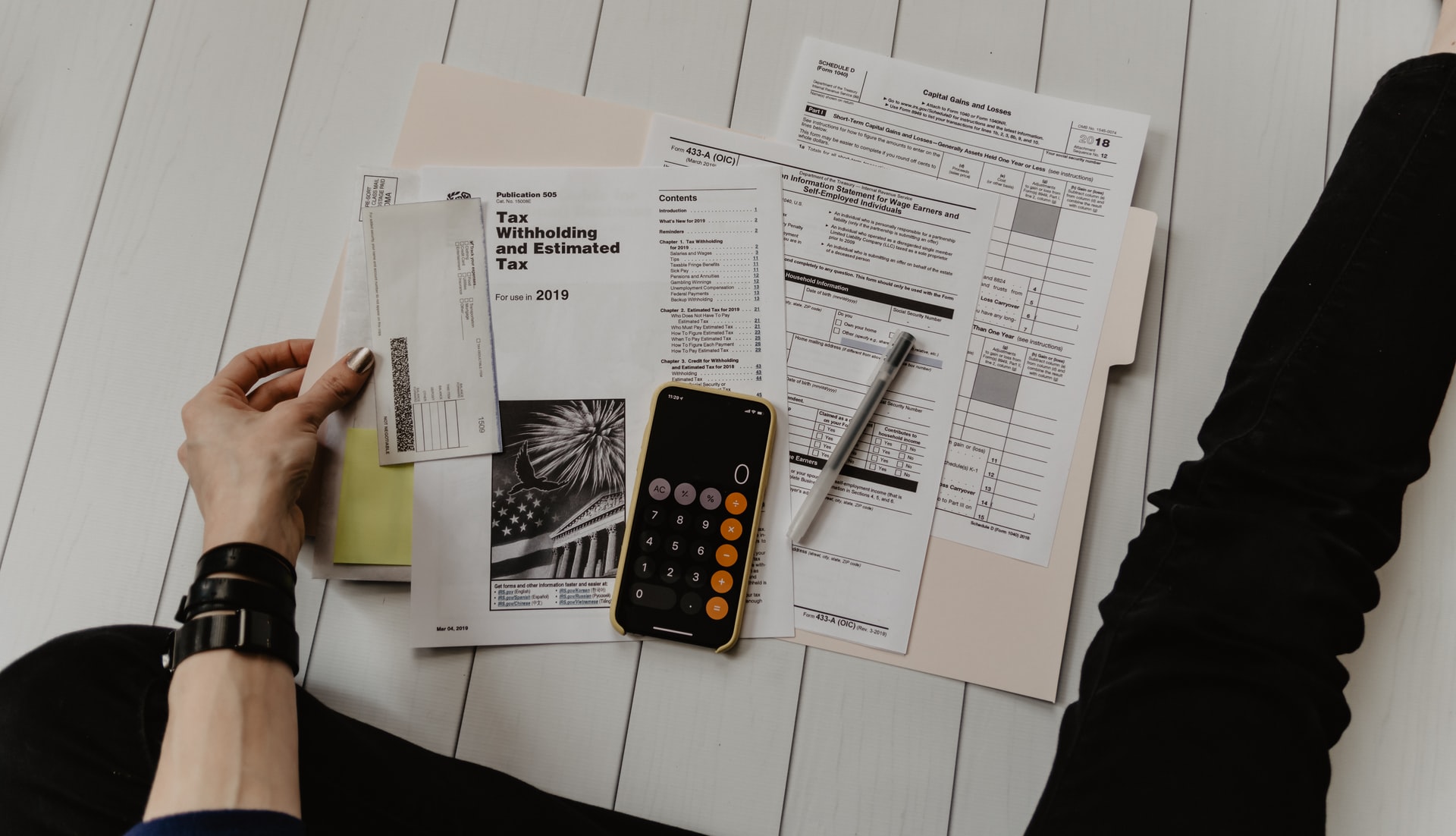

We expect you to keep your eye on your everyday work expenditures. Each of the paper and ink you purchased for your printer, together with the stamps you’ve bought for your leaflet senders, are okay as a daily investment for smaller companies so long as you have the receipts to show that you created these purchases. There are very few freelancers working on the pc. A number sell things they create in the home. These folks will need to remember to accumulate the materials used to make those products. Lots of men and women will need to apply for loans to begin or keep their company independently or in the home. If it applies to you personally, you need to think about that interest on those loans may be subtracted from your earnings.

We expect you to keep your eye on your everyday work expenditures. Each of the paper and ink you purchased for your printer, together with the stamps you’ve bought for your leaflet senders, are okay as a daily investment for smaller companies so long as you have the receipts to show that you created these purchases. There are very few freelancers working on the pc. A number sell things they create in the home. These folks will need to remember to accumulate the materials used to make those products. Lots of men and women will need to apply for loans to begin or keep their company independently or in the home. If it applies to you personally, you need to think about that interest on those loans may be subtracted from your earnings. In case you’ve visited your business in the previous calendar year, you may undoubtedly reassess these travelling expenses. Be aware there are two sorts of company trips for the self-explanatory: excursions explicitly created for the company and no other motive, and expeditions made partially for business and partly for pleasure. Even when you’re not far from your hometown, you can use transport for your job. The manual could be required for client meetings, trips to media events, and even driving into the store to buy office equipment.

In case you’ve visited your business in the previous calendar year, you may undoubtedly reassess these travelling expenses. Be aware there are two sorts of company trips for the self-explanatory: excursions explicitly created for the company and no other motive, and expeditions made partially for business and partly for pleasure. Even when you’re not far from your hometown, you can use transport for your job. The manual could be required for client meetings, trips to media events, and even driving into the store to buy office equipment. So long as your house can also be a company, it might be helpful if you believe a proportion of your house’s price as a business investment. Discover how much of the home you use for your own company (which isn’t hard to do if you’ve got an office in your house ) and use this proportion of your mortgage or a yearly rental for tax depreciation. In cases like this, you could write off the actual remodelling prices to enhance the house office.

So long as your house can also be a company, it might be helpful if you believe a proportion of your house’s price as a business investment. Discover how much of the home you use for your own company (which isn’t hard to do if you’ve got an office in your house ) and use this proportion of your mortgage or a yearly rental for tax depreciation. In cases like this, you could write off the actual remodelling prices to enhance the house office.

Generally, it is not a fantastic idea to deal with audit proceedings yourself since you may not be conscious of what the IRS will examine. Besides, you could give more information than is required, opening up to additional scrutiny. As soon as you’ve hired a specialist to lead you through the procedure, you will have the assurance that every step you take contributes to the chance of a much better audit outcome.

Generally, it is not a fantastic idea to deal with audit proceedings yourself since you may not be conscious of what the IRS will examine. Besides, you could give more information than is required, opening up to additional scrutiny. As soon as you’ve hired a specialist to lead you through the procedure, you will have the assurance that every step you take contributes to the chance of a much better audit outcome.

Google AdSense is an essential tool that has been generated with blog and website publishers on purpose. Website publishers will essentially get paid for clicks Advertisements that resemble on their sites. Anybody who has created also preserves his websites can significantly take advantage of this superb possibility. In the event you genuinely know how to utilize the tool to your advantage, you can generate a good deal of revenue.

Google AdSense is an essential tool that has been generated with blog and website publishers on purpose. Website publishers will essentially get paid for clicks Advertisements that resemble on their sites. Anybody who has created also preserves his websites can significantly take advantage of this superb possibility. In the event you genuinely know how to utilize the tool to your advantage, you can generate a good deal of revenue. Consulting services essentially commit to specialist clinics offering specialist guidance within a particular field. There are various places where you can contemplate and supply information as seriously as your website is worried. Earning money via consultancy choices starts by formulating your expertise and procedures. Together with your skill and experience, you can continuously gain money per task basis. Manage your website to promote your explications, and you will get adequate money through consultancy.

Consulting services essentially commit to specialist clinics offering specialist guidance within a particular field. There are various places where you can contemplate and supply information as seriously as your website is worried. Earning money via consultancy choices starts by formulating your expertise and procedures. Together with your skill and experience, you can continuously gain money per task basis. Manage your website to promote your explications, and you will get adequate money through consultancy.

It’s very likely to continue to appreciate it. Should you purchase a new launch condominium now. Purchase possessions and you can use this to obtain loans. You may sell the house and spend the money in a retirement program. You can construct a retirement nest egg if you begin

It’s very likely to continue to appreciate it. Should you purchase a new launch condominium now. Purchase possessions and you can use this to obtain loans. You may sell the house and spend the money in a retirement program. You can construct a retirement nest egg if you begin  By this 2013 Index of Economic Freedom, Singapore gets got the freest market in the entire world. The Corruption Perceptions Index rankings this country among the nations on the planet. It is the importer in the world as well as the largest exporter. These figures demonstrate that Singapore is a country. What is more, the nation has an older strategy and a government, which translates into reduced risk. Investors can access funding to purchase properties. Financial institutions can provide up to overseas investors to mortgage funds. It is very important to say that conditions and the terms of these loans vary from 1 creditor to another. Periods for loans range from 25 to 35 decades. Interest rates in Singapore are low and investors don’t need to worry about capital gains taxation.

By this 2013 Index of Economic Freedom, Singapore gets got the freest market in the entire world. The Corruption Perceptions Index rankings this country among the nations on the planet. It is the importer in the world as well as the largest exporter. These figures demonstrate that Singapore is a country. What is more, the nation has an older strategy and a government, which translates into reduced risk. Investors can access funding to purchase properties. Financial institutions can provide up to overseas investors to mortgage funds. It is very important to say that conditions and the terms of these loans vary from 1 creditor to another. Periods for loans range from 25 to 35 decades. Interest rates in Singapore are low and investors don’t need to worry about capital gains taxation.

Obtaining insurance isn’t so simple. You need to show that you’re serious about usage. You need to show you have some experience in the

Obtaining insurance isn’t so simple. You need to show that you’re serious about usage. You need to show you have some experience in the

So 2013 was the breakthrough season for this cryptocurrency. Big companies started to favor bitcoin, and blockchain’s approval turned into a topic for computer science applications. A lot of individuals believed that its purpose had been served, and it would settle down. However, the money became more popular, with bitcoin ATM’s being put up around. Ethereum developed Litecoin as a faster and cheaper alternative.

So 2013 was the breakthrough season for this cryptocurrency. Big companies started to favor bitcoin, and blockchain’s approval turned into a topic for computer science applications. A lot of individuals believed that its purpose had been served, and it would settle down. However, the money became more popular, with bitcoin ATM’s being put up around. Ethereum developed Litecoin as a faster and cheaper alternative.

While most people acknowledges the importance of accounting to business, it has never been easy to locate a good accountant. This is because most education systems have failed in one way or the other. Some educational institutions produce half-baked graduates who if you employ them, you would simply be accelerating the burial of your business. This is why you should always be keen when it comes to accounting matters of your business. If possible, you should look for a company that offers these services and outsource your accounting services. Here are some of the things that you should put into consideration whenever you need an accountant for your business.

While most people acknowledges the importance of accounting to business, it has never been easy to locate a good accountant. This is because most education systems have failed in one way or the other. Some educational institutions produce half-baked graduates who if you employ them, you would simply be accelerating the burial of your business. This is why you should always be keen when it comes to accounting matters of your business. If possible, you should look for a company that offers these services and outsource your accounting services. Here are some of the things that you should put into consideration whenever you need an accountant for your business. You also need to consider the cost that it will take you to hire the accountant. If they are too expensive, then it means that they might not be of much help to you. Remember that phrase that you get what you pay for is not applicable everywhere. If you find out that hiring an accountant becomes too expensive for you to manage, you can consider outsourcing your accounting services.Check out accountants Sunderland for reliable accounting services.

You also need to consider the cost that it will take you to hire the accountant. If they are too expensive, then it means that they might not be of much help to you. Remember that phrase that you get what you pay for is not applicable everywhere. If you find out that hiring an accountant becomes too expensive for you to manage, you can consider outsourcing your accounting services.Check out accountants Sunderland for reliable accounting services.

If the music tour will involve traveling to different countries, get in touch with your travel agency and determine the best time to book your air and bus tickets. Remember that as the number of people attending the music tour increases, traveling costs may increase in line with the law of demand. If you wait until the last minute, you may but the tickets at the double the regular price. This is so especially if the tour takes place in the peak traveling season like the December holidays.

If the music tour will involve traveling to different countries, get in touch with your travel agency and determine the best time to book your air and bus tickets. Remember that as the number of people attending the music tour increases, traveling costs may increase in line with the law of demand. If you wait until the last minute, you may but the tickets at the double the regular price. This is so especially if the tour takes place in the peak traveling season like the December holidays.