Not everyone has had to deal with the possibility of being unemployed, but some are not. These recessionary times have certainly taken a toll on the household budget for most of us. If you suddenly find yourself in the ranks of the unemployed and need of a cash injection, some lenders would love to work with you. Not only is it possible to find direct lenders, but also intermediaries who want to match the unemployed.

Most loans made to the unemployed are known as unsecured loans. Many regular loans require collateral in the form of real estate or property to secure the loan. Since most unemployed people don’t want to put up collateral, lenders require more risk and interest rates and fees can be quite high. So, if the borrower has a less than perfect credit score, the loan may be approved. However many people wonder if banks give loans to the unemployed, by reading about money lender singapore you can learn about it. Here are tips to find unsecured loans for the unemployed.

Determine Your Needs

Before you start looking for a loan to solve your financial problems, you should clarify a few things. How much do you want? Do you really want that much? And why? Where will you get the money to pay it back? On what terms? Terms usually mean the amount and timing of repayment. Some loans require repayment after fourteen days. Some require monthly payments. A lot depends on you and also the volume you want.

Shop for the Best

As you shop around, start making a list of lenders who seem to be able to help you the best. Write down their terms and conditions. You should create 10 lenders as you shop. Once you have that many, pick the top five and ask them for a budget. You don’t need to start providing sensitive and secure financial information right away. Give them rough information and find out how they respond in terms of reimbursement and fees.

Start Applying

Once you have great offers from a few lenders, make a program together with the ideal one. Each online lender includes a lively interactive program form. Sooner or later, of course, you will need to provide proof of residency and identity. This is usually not too difficult but may require faxing or scanned images of the documents. You may need to send direct deposit information to your bank account. Lately, some unsecured lenders will provide you with a prepaid credit card along with your money if you do not have a bank account. Although some guarantee less time, then you could receive your money in your bank account or on a prepaid card for twenty-five hours.

Once you have great offers from a few lenders, make a program together with the ideal one. Each online lender includes a lively interactive program form. Sooner or later, of course, you will need to provide proof of residency and identity. This is usually not too difficult but may require faxing or scanned images of the documents. You may need to send direct deposit information to your bank account. Lately, some unsecured lenders will provide you with a prepaid credit card along with your money if you do not have a bank account. Although some guarantee less time, then you could receive your money in your bank account or on a prepaid card for twenty-five hours.

Payday lenders have experienced thriving success worldwide, and they attribute that success to providing a service not previously offered. They explained that emergency cash loans appear an attractive option for people who cannot or do not want to use the less expensive traditional ways of borrowing cash. Some companies offering emergency cash advances from the UK have clarified their strategy as proper financial assistance for young web-savvy borrowers who are used to the ease and advantage of instant online communication.

Payday lenders have experienced thriving success worldwide, and they attribute that success to providing a service not previously offered. They explained that emergency cash loans appear an attractive option for people who cannot or do not want to use the less expensive traditional ways of borrowing cash. Some companies offering emergency cash advances from the UK have clarified their strategy as proper financial assistance for young web-savvy borrowers who are used to the ease and advantage of instant online communication. The significant reason for getting an emergency fund is quite clear because whenever a person falls into a financial disaster situation, they might want to damage their economies by creating a commitment to finding the money. Contrary to popular belief, credit cards are the ideal method to fund a financial disaster. The fastest way to get thousands of dollars is a car loan is not a long-term option, but a short-term alternative. It is a very costly method to borrow and manage to fund in emergencies.

The significant reason for getting an emergency fund is quite clear because whenever a person falls into a financial disaster situation, they might want to damage their economies by creating a commitment to finding the money. Contrary to popular belief, credit cards are the ideal method to fund a financial disaster. The fastest way to get thousands of dollars is a car loan is not a long-term option, but a short-term alternative. It is a very costly method to borrow and manage to fund in emergencies. The rules regarding the exact amount of assistance that can be charged and the restrictions of these loans vary depending on the country, nation, county, or state in which the loan provider is located. Business is growing; perhaps faster in the United Kingdom, where there are less laws on how payday advance companies are allowed to operate. In some countries in the U.S., super high loans (such as those offered by payday advance companies) are prohibited. Locally, check to cash is just another service often offered by payday loan companies.

The rules regarding the exact amount of assistance that can be charged and the restrictions of these loans vary depending on the country, nation, county, or state in which the loan provider is located. Business is growing; perhaps faster in the United Kingdom, where there are less laws on how payday advance companies are allowed to operate. In some countries in the U.S., super high loans (such as those offered by payday advance companies) are prohibited. Locally, check to cash is just another service often offered by payday loan companies.

Whenever you are most likely to take a vacation, you will find several strategies to relax and top up your budget, from choosing local destinations to making more sense of your vacation time. If you make the right decisions, like going out to dinner or how much to spend at the hotel and taking a cab or walk, your vacation will be anything but relaxing. That’s why you need to address these options until you get on the plane. Plan how you will be welcomed in your environment. And when you arrive, be sure to take advantage of extra travel tips such as withdrawing money from local ATMs at a great exchange rate or finding a place to cook Airbnb so you can see the sights and eat on a budget at once.

Whenever you are most likely to take a vacation, you will find several strategies to relax and top up your budget, from choosing local destinations to making more sense of your vacation time. If you make the right decisions, like going out to dinner or how much to spend at the hotel and taking a cab or walk, your vacation will be anything but relaxing. That’s why you need to address these options until you get on the plane. Plan how you will be welcomed in your environment. And when you arrive, be sure to take advantage of extra travel tips such as withdrawing money from local ATMs at a great exchange rate or finding a place to cook Airbnb so you can see the sights and eat on a budget at once.

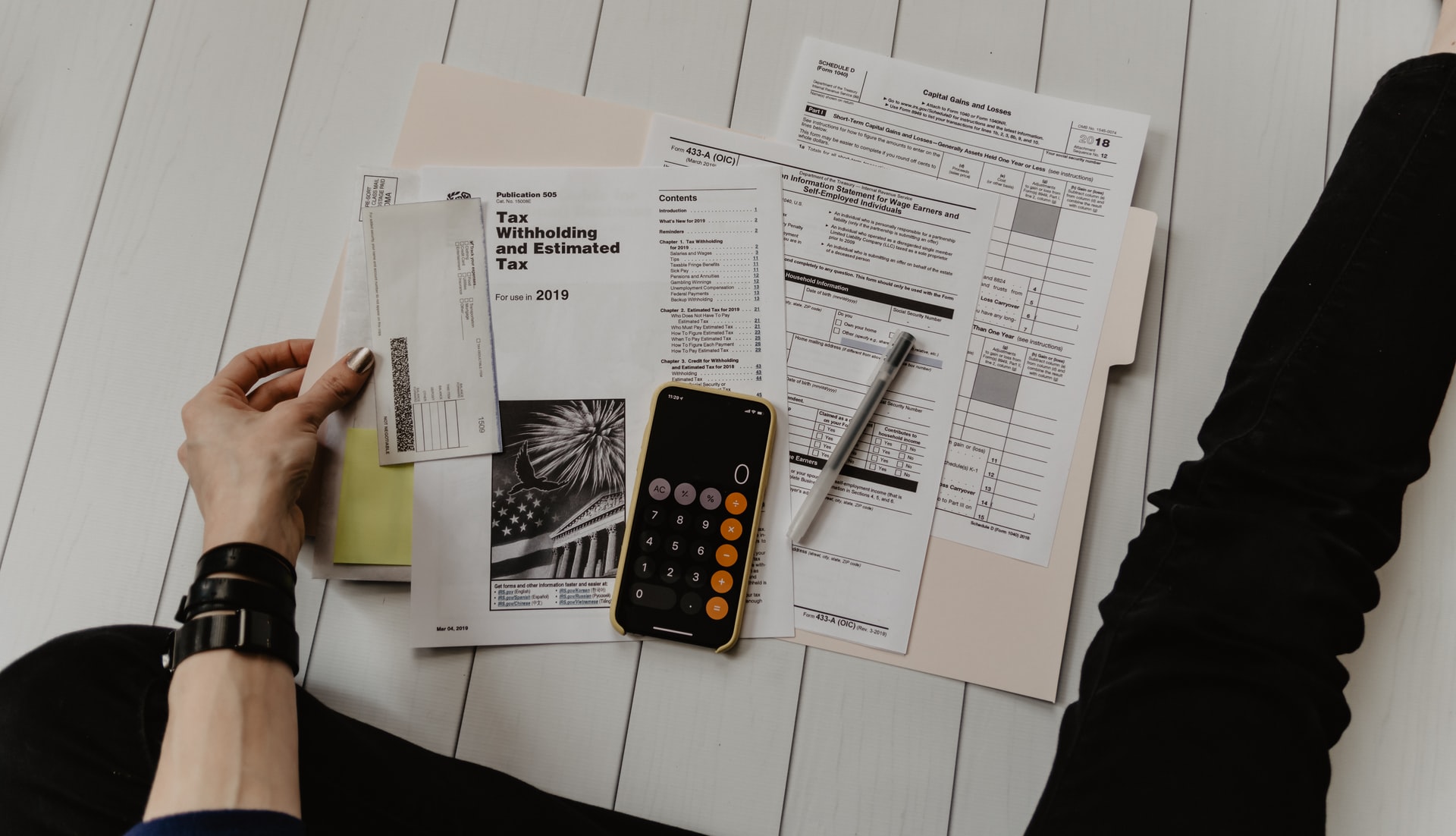

We expect you to keep your eye on your everyday work expenditures. Each of the paper and ink you purchased for your printer, together with the stamps you’ve bought for your leaflet senders, are okay as a daily investment for smaller companies so long as you have the receipts to show that you created these purchases. There are very few freelancers working on the pc. A number sell things they create in the home. These folks will need to remember to accumulate the materials used to make those products. Lots of men and women will need to apply for loans to begin or keep their company independently or in the home. If it applies to you personally, you need to think about that interest on those loans may be subtracted from your earnings.

We expect you to keep your eye on your everyday work expenditures. Each of the paper and ink you purchased for your printer, together with the stamps you’ve bought for your leaflet senders, are okay as a daily investment for smaller companies so long as you have the receipts to show that you created these purchases. There are very few freelancers working on the pc. A number sell things they create in the home. These folks will need to remember to accumulate the materials used to make those products. Lots of men and women will need to apply for loans to begin or keep their company independently or in the home. If it applies to you personally, you need to think about that interest on those loans may be subtracted from your earnings. In case you’ve visited your business in the previous calendar year, you may undoubtedly reassess these travelling expenses. Be aware there are two sorts of company trips for the self-explanatory: excursions explicitly created for the company and no other motive, and expeditions made partially for business and partly for pleasure. Even when you’re not far from your hometown, you can use transport for your job. The manual could be required for client meetings, trips to media events, and even driving into the store to buy office equipment.

In case you’ve visited your business in the previous calendar year, you may undoubtedly reassess these travelling expenses. Be aware there are two sorts of company trips for the self-explanatory: excursions explicitly created for the company and no other motive, and expeditions made partially for business and partly for pleasure. Even when you’re not far from your hometown, you can use transport for your job. The manual could be required for client meetings, trips to media events, and even driving into the store to buy office equipment. So long as your house can also be a company, it might be helpful if you believe a proportion of your house’s price as a business investment. Discover how much of the home you use for your own company (which isn’t hard to do if you’ve got an office in your house ) and use this proportion of your mortgage or a yearly rental for tax depreciation. In cases like this, you could write off the actual remodelling prices to enhance the house office.

So long as your house can also be a company, it might be helpful if you believe a proportion of your house’s price as a business investment. Discover how much of the home you use for your own company (which isn’t hard to do if you’ve got an office in your house ) and use this proportion of your mortgage or a yearly rental for tax depreciation. In cases like this, you could write off the actual remodelling prices to enhance the house office.

Generally, it is not a fantastic idea to deal with audit proceedings yourself since you may not be conscious of what the IRS will examine. Besides, you could give more information than is required, opening up to additional scrutiny. As soon as you’ve hired a specialist to lead you through the procedure, you will have the assurance that every step you take contributes to the chance of a much better audit outcome.

Generally, it is not a fantastic idea to deal with audit proceedings yourself since you may not be conscious of what the IRS will examine. Besides, you could give more information than is required, opening up to additional scrutiny. As soon as you’ve hired a specialist to lead you through the procedure, you will have the assurance that every step you take contributes to the chance of a much better audit outcome.

Google AdSense is an essential tool that has been generated with blog and website publishers on purpose. Website publishers will essentially get paid for clicks Advertisements that resemble on their sites. Anybody who has created also preserves his websites can significantly take advantage of this superb possibility. In the event you genuinely know how to utilize the tool to your advantage, you can generate a good deal of revenue.

Google AdSense is an essential tool that has been generated with blog and website publishers on purpose. Website publishers will essentially get paid for clicks Advertisements that resemble on their sites. Anybody who has created also preserves his websites can significantly take advantage of this superb possibility. In the event you genuinely know how to utilize the tool to your advantage, you can generate a good deal of revenue. Consulting services essentially commit to specialist clinics offering specialist guidance within a particular field. There are various places where you can contemplate and supply information as seriously as your website is worried. Earning money via consultancy choices starts by formulating your expertise and procedures. Together with your skill and experience, you can continuously gain money per task basis. Manage your website to promote your explications, and you will get adequate money through consultancy.

Consulting services essentially commit to specialist clinics offering specialist guidance within a particular field. There are various places where you can contemplate and supply information as seriously as your website is worried. Earning money via consultancy choices starts by formulating your expertise and procedures. Together with your skill and experience, you can continuously gain money per task basis. Manage your website to promote your explications, and you will get adequate money through consultancy.

Investing in bitcoin is a significant venture that you should take seriously. In the online world, scammers and hackers are prevalent, and they are looking for unsuspecting people that they can steal valuable information and cryptocurrencies from. This kind of investment takes place on the Internet, so you should be vigilant. Cryptocurrency is one of the most expensive investments you can have online, so it is also exposed to many risks. If you want to secure your bitcoin wallet, it would be best to encrypt it for extra security and use an extremely difficult password to figure out. It would also help if you take a backup of your bitcoin wallet and store it safely in different locations.

Investing in bitcoin is a significant venture that you should take seriously. In the online world, scammers and hackers are prevalent, and they are looking for unsuspecting people that they can steal valuable information and cryptocurrencies from. This kind of investment takes place on the Internet, so you should be vigilant. Cryptocurrency is one of the most expensive investments you can have online, so it is also exposed to many risks. If you want to secure your bitcoin wallet, it would be best to encrypt it for extra security and use an extremely difficult password to figure out. It would also help if you take a backup of your bitcoin wallet and store it safely in different locations.

It’s very likely to continue to appreciate it. Should you purchase a new launch condominium now. Purchase possessions and you can use this to obtain loans. You may sell the house and spend the money in a retirement program. You can construct a retirement nest egg if you begin

It’s very likely to continue to appreciate it. Should you purchase a new launch condominium now. Purchase possessions and you can use this to obtain loans. You may sell the house and spend the money in a retirement program. You can construct a retirement nest egg if you begin  By this 2013 Index of Economic Freedom, Singapore gets got the freest market in the entire world. The Corruption Perceptions Index rankings this country among the nations on the planet. It is the importer in the world as well as the largest exporter. These figures demonstrate that Singapore is a country. What is more, the nation has an older strategy and a government, which translates into reduced risk. Investors can access funding to purchase properties. Financial institutions can provide up to overseas investors to mortgage funds. It is very important to say that conditions and the terms of these loans vary from 1 creditor to another. Periods for loans range from 25 to 35 decades. Interest rates in Singapore are low and investors don’t need to worry about capital gains taxation.

By this 2013 Index of Economic Freedom, Singapore gets got the freest market in the entire world. The Corruption Perceptions Index rankings this country among the nations on the planet. It is the importer in the world as well as the largest exporter. These figures demonstrate that Singapore is a country. What is more, the nation has an older strategy and a government, which translates into reduced risk. Investors can access funding to purchase properties. Financial institutions can provide up to overseas investors to mortgage funds. It is very important to say that conditions and the terms of these loans vary from 1 creditor to another. Periods for loans range from 25 to 35 decades. Interest rates in Singapore are low and investors don’t need to worry about capital gains taxation.

Obtaining insurance isn’t so simple. You need to show that you’re serious about usage. You need to show you have some experience in the

Obtaining insurance isn’t so simple. You need to show that you’re serious about usage. You need to show you have some experience in the

So 2013 was the breakthrough season for this cryptocurrency. Big companies started to favor bitcoin, and blockchain’s approval turned into a topic for computer science applications. A lot of individuals believed that its purpose had been served, and it would settle down. However, the money became more popular, with bitcoin ATM’s being put up around. Ethereum developed Litecoin as a faster and cheaper alternative.

So 2013 was the breakthrough season for this cryptocurrency. Big companies started to favor bitcoin, and blockchain’s approval turned into a topic for computer science applications. A lot of individuals believed that its purpose had been served, and it would settle down. However, the money became more popular, with bitcoin ATM’s being put up around. Ethereum developed Litecoin as a faster and cheaper alternative.

You may need help developing a payment or obtaining information. Contacting customer service should be quick and easy. They should be more willing to help you online or by phone. You can’t accomplish anything; when you need help the most, the last thing you need is to learn. Email schedules, and you can let it go. Stick to the results.

You may need help developing a payment or obtaining information. Contacting customer service should be quick and easy. They should be more willing to help you online or by phone. You can’t accomplish anything; when you need help the most, the last thing you need is to learn. Email schedules, and you can let it go. Stick to the results.

Gold can not be produced; it is just what it is. That is the main reason gold worth was utilized for decades. To a point, I regret to say paper currencies are becoming somewhat suspicious. Thus, it is my view that gold bullion, rather than being the barbarous relic clarified.

Gold can not be produced; it is just what it is. That is the main reason gold worth was utilized for decades. To a point, I regret to say paper currencies are becoming somewhat suspicious. Thus, it is my view that gold bullion, rather than being the barbarous relic clarified.

It is essential to check out for fees. A debit card is not somewhere that you put and withdraw money. It is necessary to know the type of fees that you will be charged. When you learn the different fees, it will be easy to avoid them.

It is essential to check out for fees. A debit card is not somewhere that you put and withdraw money. It is necessary to know the type of fees that you will be charged. When you learn the different fees, it will be easy to avoid them.

The best way to improve your savings is simply to increase the amount that you earn. Increasing your earnings means that you have more to put into your savings account. You simply need to ensure that your needs do not increase proportionately to the increased amount so that you are left with extra money for saving. You can improve your income through many ways. Among the top ones include investing in business, working extra hours, or taking a part-time job.

The best way to improve your savings is simply to increase the amount that you earn. Increasing your earnings means that you have more to put into your savings account. You simply need to ensure that your needs do not increase proportionately to the increased amount so that you are left with extra money for saving. You can improve your income through many ways. Among the top ones include investing in business, working extra hours, or taking a part-time job.

For the bail bond company to begin processing the bail, they’ll need you to provide them with vital pieces of information such as the full and legal names of the person you want to help out, their date of birth, the nature of their supposed crime and what your relationship is with them.

For the bail bond company to begin processing the bail, they’ll need you to provide them with vital pieces of information such as the full and legal names of the person you want to help out, their date of birth, the nature of their supposed crime and what your relationship is with them.

While most people acknowledges the importance of accounting to business, it has never been easy to locate a good accountant. This is because most education systems have failed in one way or the other. Some educational institutions produce half-baked graduates who if you employ them, you would simply be accelerating the burial of your business. This is why you should always be keen when it comes to accounting matters of your business. If possible, you should look for a company that offers these services and outsource your accounting services. Here are some of the things that you should put into consideration whenever you need an accountant for your business.

While most people acknowledges the importance of accounting to business, it has never been easy to locate a good accountant. This is because most education systems have failed in one way or the other. Some educational institutions produce half-baked graduates who if you employ them, you would simply be accelerating the burial of your business. This is why you should always be keen when it comes to accounting matters of your business. If possible, you should look for a company that offers these services and outsource your accounting services. Here are some of the things that you should put into consideration whenever you need an accountant for your business. You also need to consider the cost that it will take you to hire the accountant. If they are too expensive, then it means that they might not be of much help to you. Remember that phrase that you get what you pay for is not applicable everywhere. If you find out that hiring an accountant becomes too expensive for you to manage, you can consider outsourcing your accounting services.Check out accountants Sunderland for reliable accounting services.

You also need to consider the cost that it will take you to hire the accountant. If they are too expensive, then it means that they might not be of much help to you. Remember that phrase that you get what you pay for is not applicable everywhere. If you find out that hiring an accountant becomes too expensive for you to manage, you can consider outsourcing your accounting services.Check out accountants Sunderland for reliable accounting services.

Using such services means that you will be getting the help and support that you need. This is when hiring accountants will help you. They will follow the rules and the new laws that are applied each year. They find ways to minimize your tax bill; an accountant will find the means to use the current tax laws to your advantage.

Using such services means that you will be getting the help and support that you need. This is when hiring accountants will help you. They will follow the rules and the new laws that are applied each year. They find ways to minimize your tax bill; an accountant will find the means to use the current tax laws to your advantage. As you grow, the financial part of it becomes complicated – especially if you’re employing other people.

As you grow, the financial part of it becomes complicated – especially if you’re employing other people.

If the music tour will involve traveling to different countries, get in touch with your travel agency and determine the best time to book your air and bus tickets. Remember that as the number of people attending the music tour increases, traveling costs may increase in line with the law of demand. If you wait until the last minute, you may but the tickets at the double the regular price. This is so especially if the tour takes place in the peak traveling season like the December holidays.

If the music tour will involve traveling to different countries, get in touch with your travel agency and determine the best time to book your air and bus tickets. Remember that as the number of people attending the music tour increases, traveling costs may increase in line with the law of demand. If you wait until the last minute, you may but the tickets at the double the regular price. This is so especially if the tour takes place in the peak traveling season like the December holidays.

be a facility that is nothing short of amazing. A reverse mortgage, also known as home equity conversion mortgage (HECM), is a loan facility that allows a borrower to transfer some home equity to a lender in exchange for cash without giving up the title of the property or making monthly mortgage payments. Reverse Mortgage Guide indicate that this facility is available to senior citizens who are above the age of 62 years. You are thereby granted money for a portion of equity in your home, and you get to keep your it for the rest of your life.

be a facility that is nothing short of amazing. A reverse mortgage, also known as home equity conversion mortgage (HECM), is a loan facility that allows a borrower to transfer some home equity to a lender in exchange for cash without giving up the title of the property or making monthly mortgage payments. Reverse Mortgage Guide indicate that this facility is available to senior citizens who are above the age of 62 years. You are thereby granted money for a portion of equity in your home, and you get to keep your it for the rest of your life. hly mortgage payments could be stressful and strenuous especially when you do not have a consistent source of income. The beauty of reverse mortgage is that you are not mandated to pay the monthly installments for as long as you live. Loan repayment is also payable when you sell the home or move out to another primary home.

hly mortgage payments could be stressful and strenuous especially when you do not have a consistent source of income. The beauty of reverse mortgage is that you are not mandated to pay the monthly installments for as long as you live. Loan repayment is also payable when you sell the home or move out to another primary home.

The first thing in solving your financial problems is understanding the amount of money that, you need to borrow. Remember that is the amount that you will have to repay at a later date and the more you borrow, the more you will pay regarding the interest. After knowing the amount of money that you want, the next thing is to compare the organizations that can give you the much that you want.

The first thing in solving your financial problems is understanding the amount of money that, you need to borrow. Remember that is the amount that you will have to repay at a later date and the more you borrow, the more you will pay regarding the interest. After knowing the amount of money that you want, the next thing is to compare the organizations that can give you the much that you want. Another important step is that of comparing the organization that offers these services. You need to find the best organizations that have the capability of offering you the best services. Also, you should never presume that loans with the lowest APRs are the best deals. There are lots of considerations that you need to put in place before you make such a conclusion. For more information, visit

Another important step is that of comparing the organization that offers these services. You need to find the best organizations that have the capability of offering you the best services. Also, you should never presume that loans with the lowest APRs are the best deals. There are lots of considerations that you need to put in place before you make such a conclusion. For more information, visit

ends and relatives accompanies the greatest

ends and relatives accompanies the greatest

all scanners which you can join to Smartphones. If you are busy, you can swipe credit cards on the scanner to transfer money.

all scanners which you can join to Smartphones. If you are busy, you can swipe credit cards on the scanner to transfer money.